Identifying and understanding your target customer and market segments

Many startups offer products that appeal to different market segments and target customers. But given a startup’s limited resources, you should prioritize which customers to target first.

Narrowing your focus allows you to gain more wins earlier on and build a strong reputation with early adopters. It also enables you to have a truly customer-focused business, which makes it easier to know which new products and segments to pursue next.

How to segment your market

Leverage market research to better divide your market based on similarities among groups of customers. Your goal is to identify the most attractive customer segments in each of your potential markets.

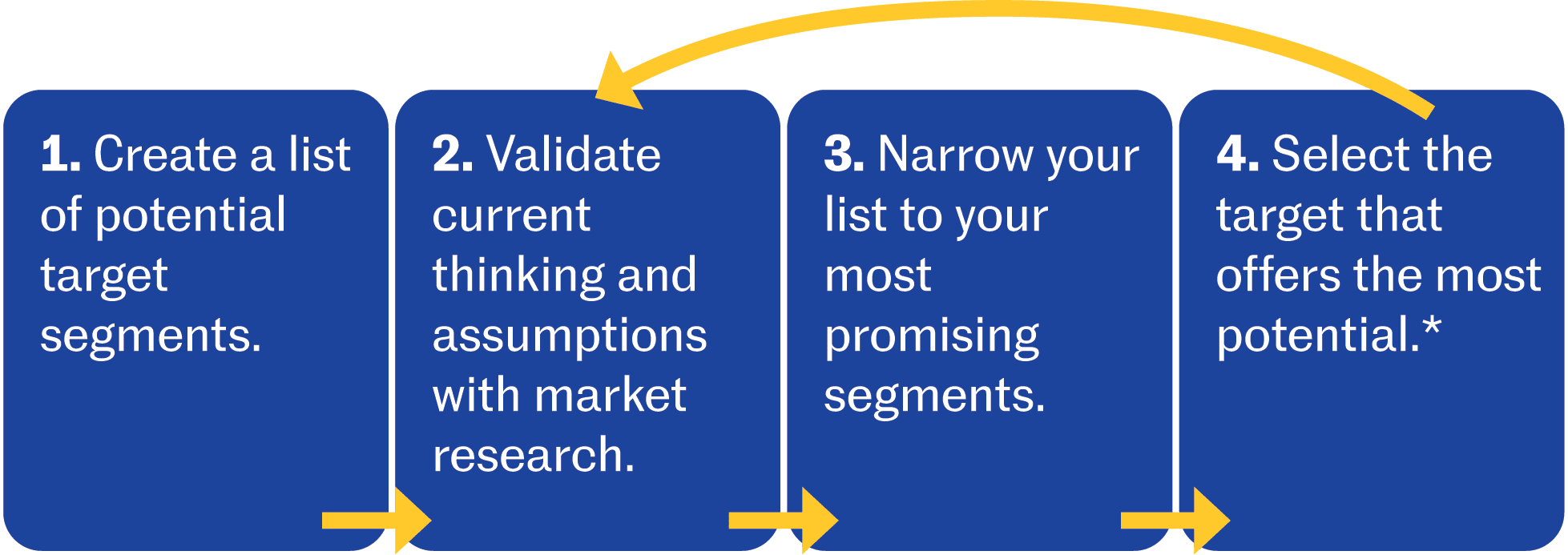

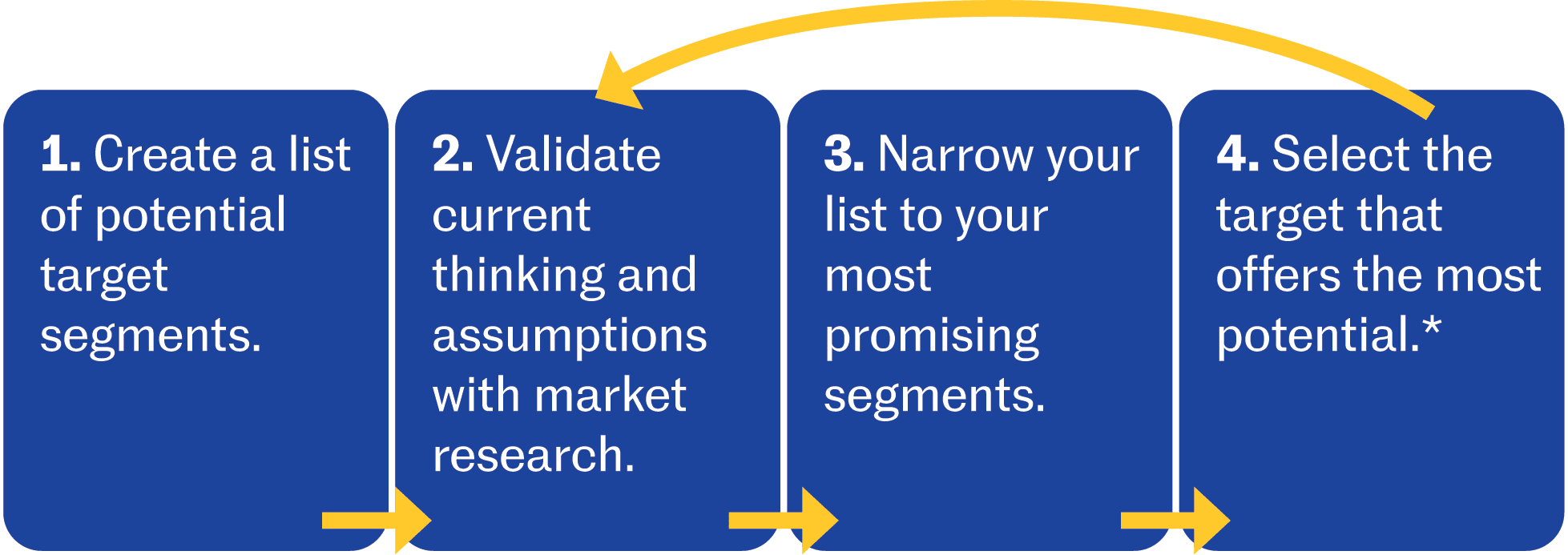

*Continuous customer research is essential to validate whether the market you’ve chosen to pursue is, and continues to be, the right fit.

Step 1: Create a list of potential target segments

Generate a list of potential target segments you think have the greatest need for your product. It’s helpful to have a hypothesis, but be careful not to predefine your target market without proof points.

For business-to-consumer (B2C) segmenting, there are different methods you can combine and use.

| Method | Segmentation factors |

| Geographic | Country, state, city and market size (consider culture) |

| Demographic | Age, gender, education, occupation, income and marital status |

| Psychographic | Attitudes, values and beliefs |

| Behavioural | Habits, usage, thought processes, and occasion and frequency of use |

| Pain points | User needs and the desired solution from your product |

B2B versus B2C

For business-to-business (B2B) markets, startups should understand who purchases their product and who are its end-users, as the decision maker can be more difficult to determine in comparison to B2C. In large organizations, decision making may be performed by groups of different people or committees, while in smaller companies, one person may be responsible for the purchasing decision.

With B2B segmenting, think firmographics instead of demographics and buying approach instead of psychographics.

| Method | Segmentation factors |

| Firmographics | Industry, firm size, global or regional and ownership |

| Buying approach | Purchasing policies, budget and involvement of decision makers |

| Behavioural | Volume, purchase frequency, attitude toward risk, loyalty and urgency |

Step 2: Validate current thinking & assumptions with market research

Secondary research will be relevant when it comes to the geographic and demographic methods, but primary research is essential for understanding customers’ values, habits and pain points. So ensure you speak to current and potential customers, and let the data and insights they provide guide you. Look for patterns in your data, and group customers with similar attributes (for example, preferences, pain points and demographics) into your target customer segments.

Step 3: Narrow your list to the most promising segments

If you have several customer segments, you should assess the attractiveness of each one based on:

- Market size

- Potential profitability (market growth)

- Barriers to entry (competition, regulations)

- Ability to meet the demand (capabilities, resources)

Step 4: Select the target customer that offers the most near-term potential

When selecting your target customer segment, think of these three aspects.

- Near-term versus long-term market opportunities: In many cases, you may want to consider which segment might be a smaller market you can easily enter now and plan to enter larger market segments after you’ve gained traction.

- Product–market fit: Decide which market segment will have the highest product–market fit and where your value proposition will resonate the most.

- Positioning: Consider which target segment you can best position your product to. This includes pricing, marketing, sales and distribution methods.

Key takeaways

Companies may segment the same market differently depending on how they view their customers and the value they offer. Regardless of your company’s approach, without segmentation, you risk overlooking opportunities and will lack direction to better serve customers’ needs. Remember that continuous customer research is essential to validate whether the market you’ve chosen to pursue is, and continues to be, the right fit.