Tips & tricks: Pitching as a cleantech startup

A common challenge for startups is the ability to secure funding, and this remains especially true for cleantech startups. Below we outline four tips to help your cleantech startup when preparing your fundraising pitch:

- Choose the right investors

- Leverage government grants

- Demonstrate policy trends to show market desire

- Measure and forecast environmental impacts with quantifiable numbers

1. Choose the right investors

When developing your pitching strategy, identifying the right investors to pitch to will set your fundraising up for success. The general factors that startups must evaluate when selecting target investors include investors’ values, investment thesis, and the sector expertise and networks investors can bring to the table. Specifically, for cleantech startups, the sector’s capital-intensive nature and unpredictable time-to-market timelines add challenging layers to finding the right investors.

Impact investments offer an effective solution to this hurdle. Impact investors make investments with the intention to generate measurable, positive social and environmental outcomes alongside a positive financial return. Impact investments are considered patient, risk-bearing capitals that target returns from below market to market rate, which are ideal for cleantech startups.

Leah Perry, Senior Manager of MaRS Venture Services, Cleantech, also suggests it’s crucial to conduct thorough research and look at the existing portfolio of your target impact investors. This helps you to better understand their investment preferences, such as whether they focus on software versus hardware or prioritize technologies that generate big versus small, incremental impacts. If you don’t see any existing investments in your specific sectors, it’s not worth your time.

Capital Insights service:

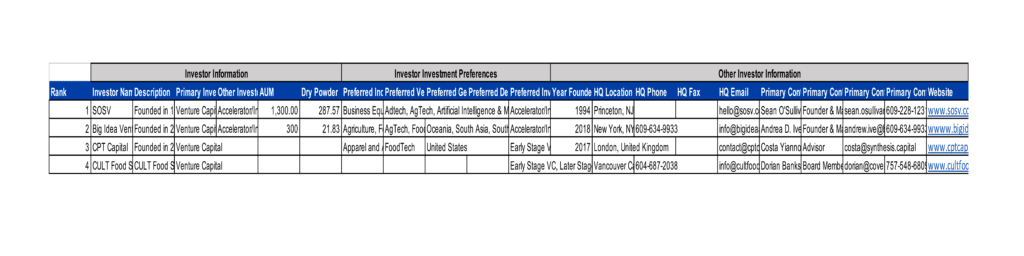

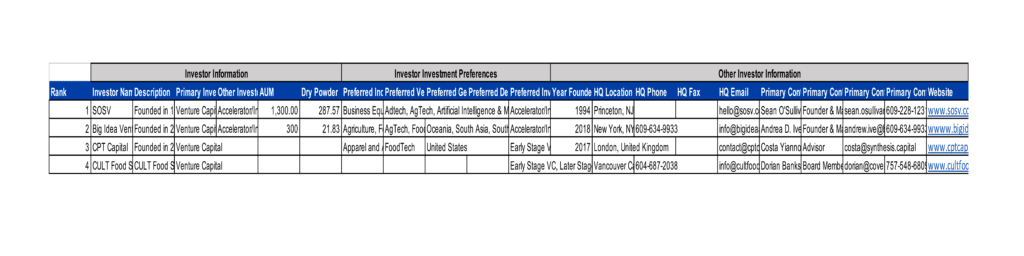

At MaRS, the Market Intelligence team provides the Capital Insights service dedicated to supporting our ventures’ fundraising planning. The Capital Insights service, powered by Pitchbook, equips your startup with a curated set of investment data on comparators and industry benchmarking, and a tailored list of up to 50 high potential investors (with deal history and contact information) that are identified by the deal type, size, geography, preferred industries and verticals, etc. The database also covers a wide range of investor types including impact investors that can be particularly helpful for cleantech startups.

Project output example:

To access this service, please talk to your MaRS advisor or apply to be a MaRS venture.

2. Leverage government grants

Another great source of capital for cleantech startups is government grants. In Canada, the government has set ambitious climate targets and continues to expand investments to support a variety of cleantech endeavours. Not only do government grants provide startups with non-dilutive capital at a low cost, but successful funding applications also give startups the stamp of approval, They indicate the government agencies have conducted their due diligence and believe in the company’s potential, which provides the startup with traction and de-risks the technology, adding credibility when pitching to investors.

Below are some Canadian government funding opportunities that cleantech startups can leverage:

- Business Development Canada Cleantech Practice: Offers flexible financing to cleantech firms with high scaling potential

- Clean Growth Hub – Cleantech Funding Opportunities: Compiles cleantech funding supports offered by federal, provincial and territorial governments

- National Research Council, Industrial Research Assistance program: Provides financing and advisory services to help innovation-driven Canadian SMEs develop and commercialize new technology and hire talents

- Scientific Research and Experimental Development (SR&ED) Tax Credit program: Rewards companies conducting Research and Development activities in Canada with tax credits

- Sustainable Development Technology Canada: Invests in seed, startup and scale-up stage cleantech startups addressing climate change, clean air, clean water and clean soil

3. Demonstrate policy trends to show market desire

The demand for cleantech is largely driven by global and regional environmental targets and government policies. By conducting market research and identifying the relevant goals and policy development to include in your pitch, you can strengthen your Total Addressable Market (TAM) claims and product-market fit to showcase strong market desire.

| For example, if you have an electric vehicle solution targeting the Canadian market, and the Government of Canada has set a mandatory target for all new light-duty cars and passenger trucks to be zero-emission by 2035, this is great supporting evidence to prove the necessity and growing market size of your solution. |

Staying up to date with the latest trends is crucial for cleantech startups aiming to develop a compelling pitch. MaRS Market Intelligence can provide access to globally recognized market research reports with insights on relevant regulatory landscapes.

4. Measure and forecast environmental impacts with quantifiable numbers

With the increase in the number of impact investors in the cleantech space, more investors have mandates from their limited partners to meet certain impact targets. The potential of an investment to reduce greenhouse gas emissions has become a core element of their investment criteria and investors are also asking for a cleantech startup’s impact statistics a lot earlier in the process.

For cleantech startups, if you want to tap into these sources of capital and gain a competitive edge, look for tools that can help you better quantitatively measure and forecast your environmental impacts. It goes a long way if you can save investors time by providing your impact metrics in your pitch and ensure you can stand behind the numbers.

Quantifying environmental impacts is a technical and complicated task that can be confusing at times due to challenges around data collection and lack of measurement standardization, but there are some simple tools available that can help your startup begin with some rough estimations:

Further resources: