Smooth cash flow and extend your runway with SR&ED financing

As a startup founder in Canada’s vibrant innovation ecosystem, two concepts involving your business will undoubtedly be top of mind: cash burn rate and runway. Cash burn rate refers to the rate at which a company exhausts its cash reserves. Runway is the length of time before a startup—running at its current cash burn rate—will run out of money and need to source capital either through revenue generation or external sources.

The challenge to balance growth and cash burn is more pronounced if you’re at the helm of a pre-revenue startup. Extending your company’s runway can seem daunting, as seeking external capital is your only option.

SR&ED financing: A cure for the cash burn

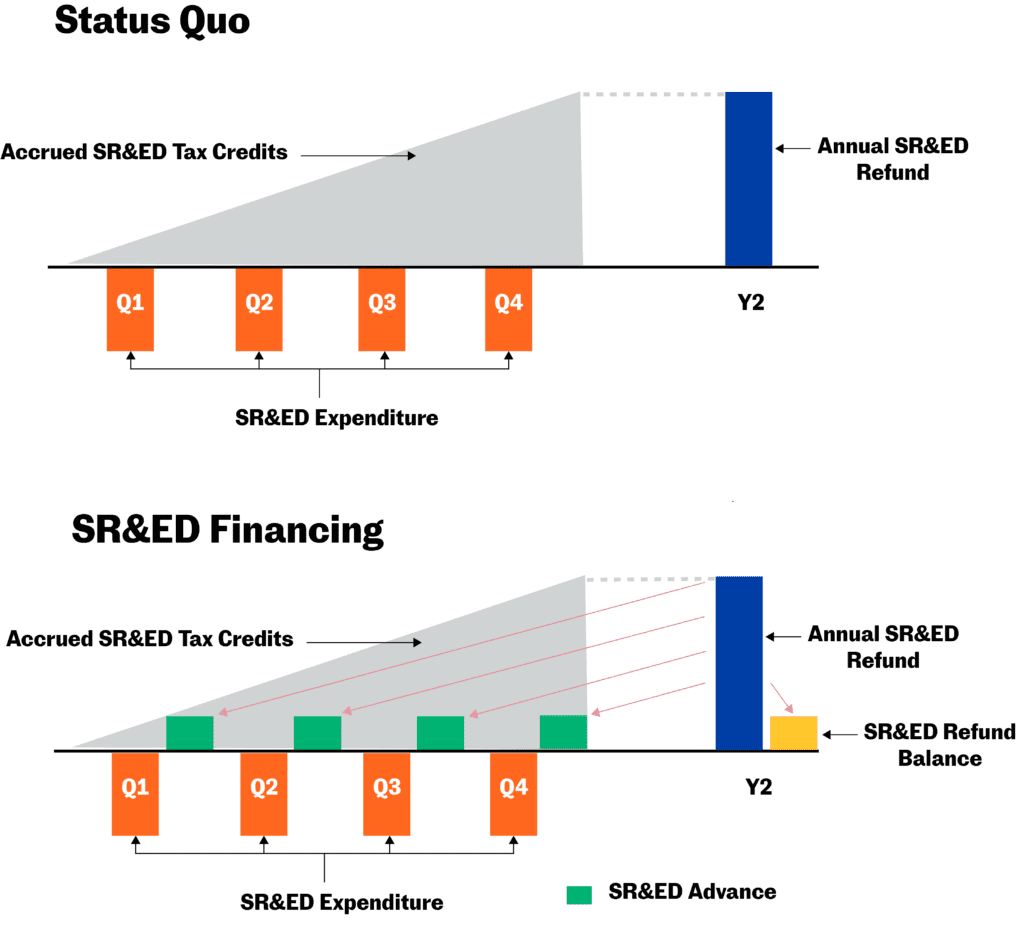

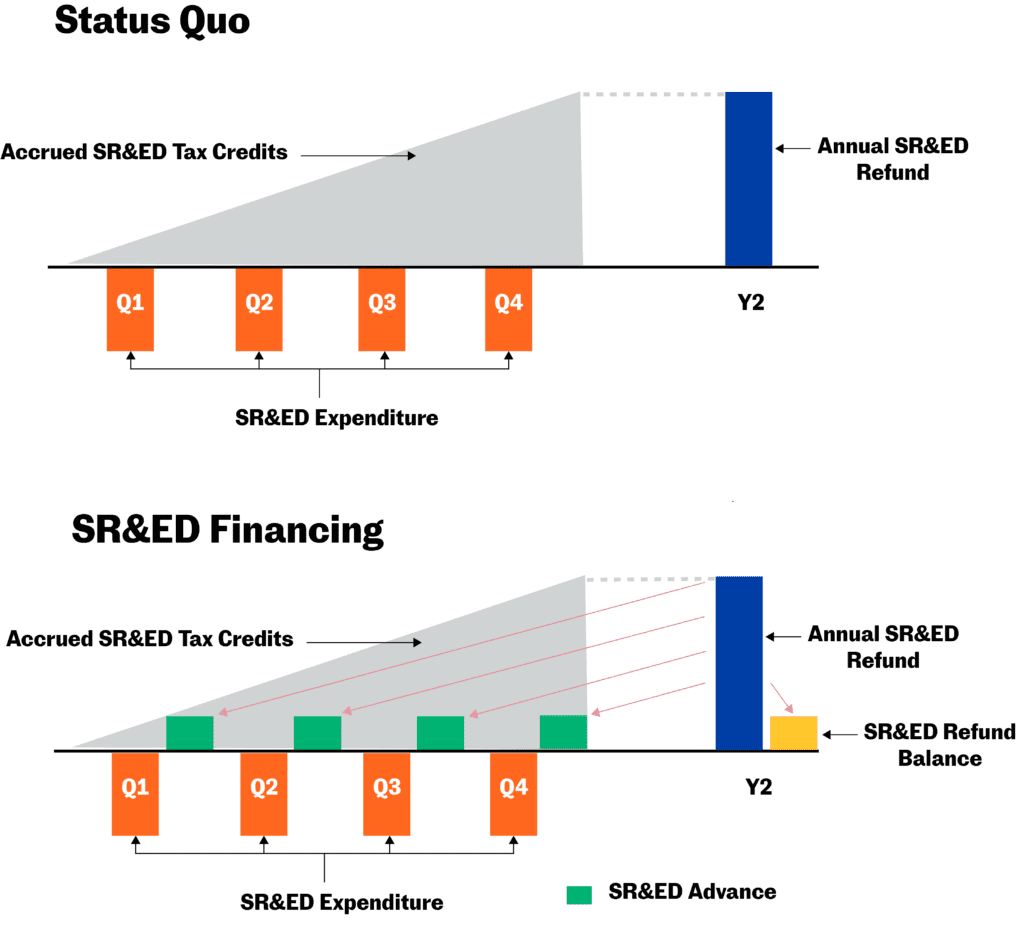

SR&ED financing is an innovative solution for companies that claim SR&ED tax credits, as it directly addresses their cash flow management challenges. With this financing option, you can tap into your accrued refundable SR&ED tax credits up to 18 months sooner. Instead of waiting for the annual disbursement from the Canada Revenue Agency (CRA), your company can receive cash advances against your accrued refundable SR&ED tax credits, providing an immediate cash flow injection. As you accrue more credits, you can receive more advances.

With SR&ED financing, you can transform a single annual SR&ED refund into regular cash inflows to help smooth your cash flow throughout the year. This regular cash infusion can provide a measure of financial stability, add a buffer around your cash burn rate and extend your runway, giving your company more time and flexibility to reach its milestones, become cash flow positive and, ultimately, achieve long-term success.

The above graphic makes the following assumptions:

- SR&ED expenditures are evenly distributed throughout the year.

- Company is based in Ontario and receiving refundable federal tax credits (35%) and provincial tax credits (8%) to total 43% refundable tax credits.

- SR&ED advances are 75% Loan-to-value (based on accrued SR&ED) less a 2% disbursement fee.

- Nominal (not actual) interest rate of all loans together is 8% over the course of the year.

- This is used to calculate the remainder of the CRA refund disbursed to the company after principal and interest are paid to the creditor (the yellow bar to the right of the blue annual refund bar).

Unlocking the benefits of SR&ED financing: What to look for

When considering SR&ED financing, you should understand what to look for to unlock its full potential. A good SR&ED financing provider should offer benefits that align with the needs of your business, whether you’re a startup or growth-stage company:

- No cost to apply: Starting a business is costly enough. Look for a provider with no application fees, reducing the initial financial barriers to accessing funding.

- Clear, standardized terms: Understanding financial terms shouldn’t feel like learning a new language. You’ll want straightforward, easy-to-understand terms that offer transparency and eliminate unpleasant surprises down the line.

- No monthly servicing fees: As a growing startup, cash conservation is key. Look for a provider that doesn’t burden you with monthly servicing fees like many traditional forms of debt do. That means this capital source will not add to your cash burn burden.

- Flexible access to capital: Every company’s needs are unique. Ensure your provider allows you to access funding on a schedule that suits your business’s needs, providing further stability to your cash management and operational planning.

- Founder-friendly: Some sources of financing come with demanding reporting covenants and restrictions on how you can use the provided funds. An ideal SR&ED financing provider will have no covenants, no restrictions on the use of funds and not require personal guarantees.

To get a clearer picture of the SR&ED tax credits your company might qualify for, consider using an SR&ED calculator, like the one developed by Easly, a leading SR&ED financing provider. The calculator includes different amounts of tax credits earned for different expenditures, as well as different provincial and territorial reimbursement rates and provides you an estimate of the capital you could access using SR&ED financing.

Ultimately, SR&ED financing is more than a source of capital—it’s a strategic tool you can employ to better manage cash flow and take control of your funding timeline. This often-overlooked financial strategy can unlock your company’s potential and fuel your journey to long-term sustainability and success.

About Easly:

Easly supports innovation across Canada by providing non-dilutive capital to companies that receive investment tax credit (ITC) refunds, such as those awarded through the Scientific Research & Experimental Development Program (SR&ED). We enable our customers to control the flow of capital, turning their annual lump-sum ITC refund from a distant receivable into cash in their bank account.