How to estimate the value of your startup

As a growing startup in the process of raising capital, it is key to understand the true value of your venture. Entrepreneurs require specific knowledge and tools to conduct a valuation analysis. An accurate estimate and understanding of your startup’s worth enables you, as a founder, to present a compelling case for funding and negotiate fair terms to secure the financial resources needed to achieve your startup’s full potential.

In this guide, we’ll walk through a commonly used method that investors use to evaluate startups. This approach is called comparable company analysis (comps analysis).

Understanding comps analysis

Comparable company analysis (comps analysis) is commonly employed across all stages and is often combined with other valuation methods. Investors use comps analysis to estimate the value of a startup by comparing it to other companies within a similar industry and business model. The premise is that companies with similar characteristics to your startup are likely to have similar valuation multiples.

Comps analysis can involve three types of comparable companies:

- Public company comparables

- Transaction comparables (similar companies being acquired)

- Financing comparables (similar companies raising a new round of funding)

This guide will focus on public company comparables, the most common and accessible method used across all stages and industries.

Use the following steps to conduct your own public comps analysis.

1. Identify comparable companies

Several factors determine whether or not a company is a good comparable for your startup. When identifying comparable companies, consider the following:

- Industry

- Business model (e.g., B2B or B2C, capital intensive or capital light)

- Financials (margins and profitability)

- Geographical location

Compare six to ten public companies to gather the most robust valuation data.

2. Gather financial data

Once you’ve identified a set of comparable companies, gather their financial data. This data usually includes enterprise value, revenue, profit and EBITDA margins, growth rates and other relevant financial metrics.

The following resources are useful for obtaining this financial data:

| Publicly available sources | Private databases |

|

|

While several resources can be used for data collection, maintain consistency amongst sources and check for accuracy to ensure reliable analysis.

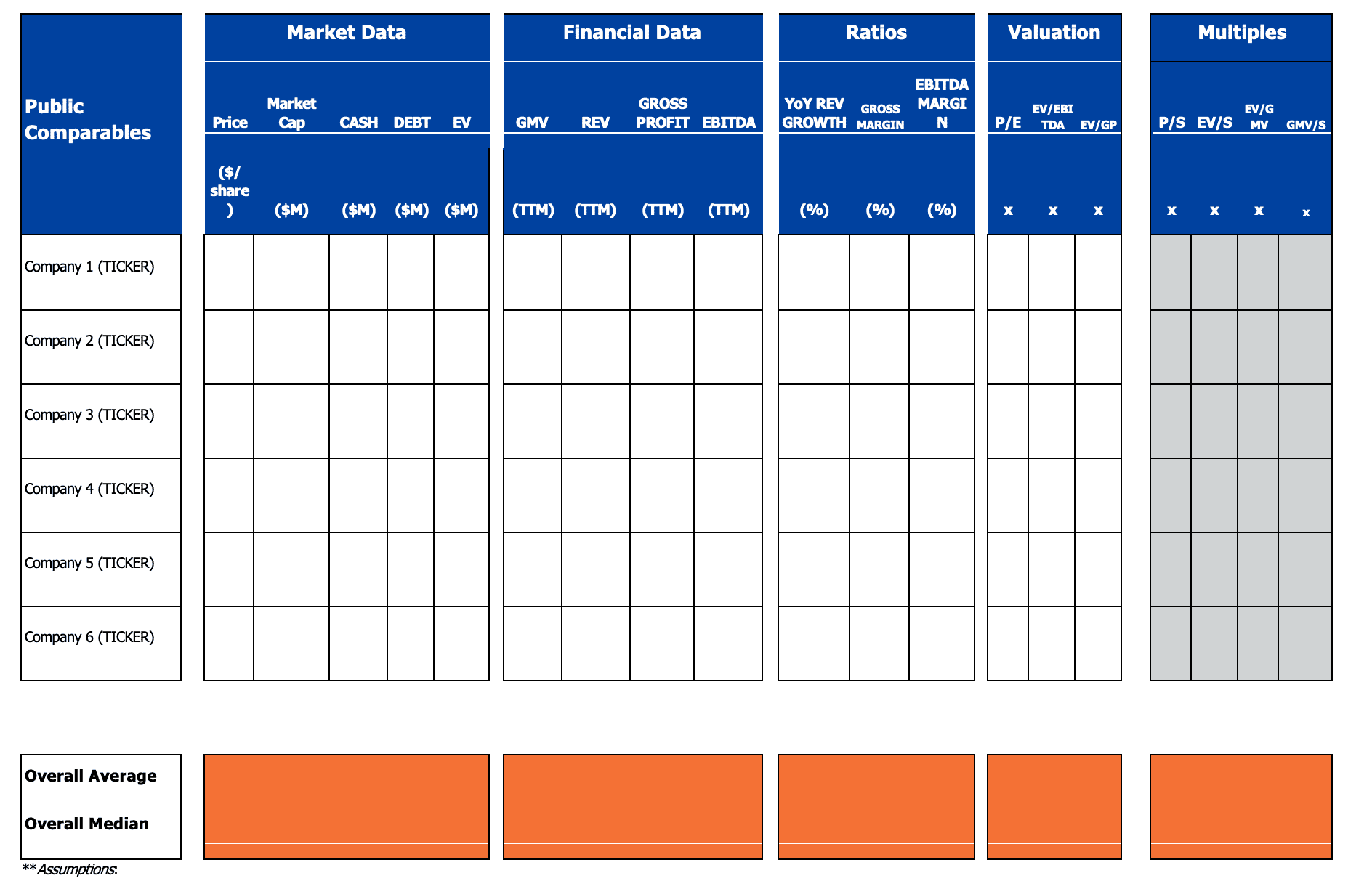

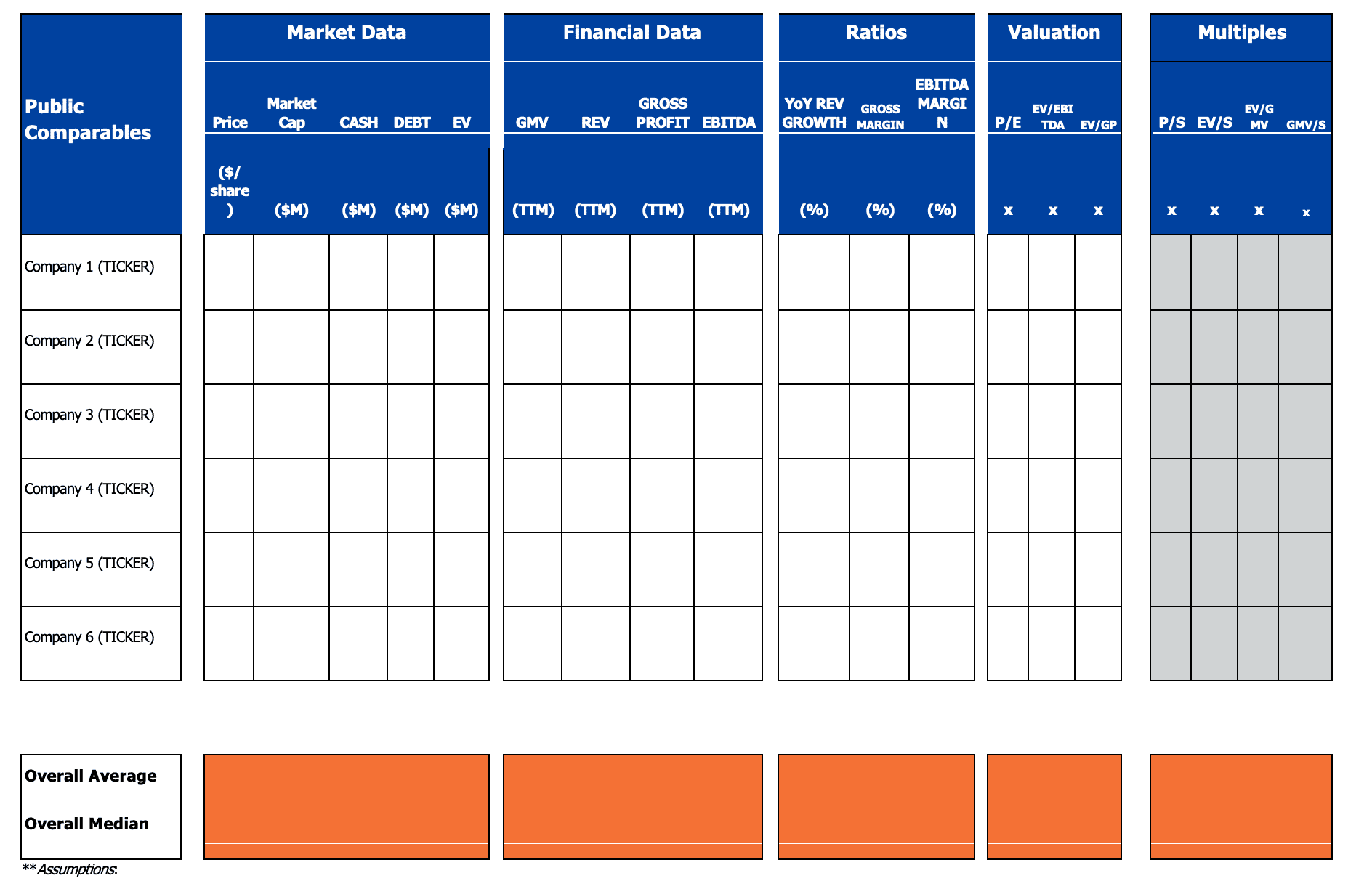

3. Format your table

When collecting your list of comparables and their respective financials, use a table to clearly organize the data and effectively calculate results.

Group market data, financial data and multiples into distinct sections. Ensure the table concludes with the average and median calculations and indicate any assumptions or adjustments made underneath.

Below is one example of how to format your table:

4. Analyze valuation multiples

The final step is to calculate and analyze the valuation multiples. Multiples represent the ratio of one financial metric to another. They provide a straightforward measurement for comparing performance between companies.

Common types of valuation multiples calculated in comps analysis include:

- Price-to-earnings ratio (P/E)

- Price-to-sales ratio (P/S)

- Enterprise value-to-revenue ratio (EV/REV)

- Enterprise value-to-EBITDA ratio (EV/EBITDA)

To calculate the final valuation, multiply each multiple by its related metric. For example:

P/S × SALES = COMPANY VALUE

P/E × EARNINGS = COMPANY VALUE

EV/REV × REVENUE = COMPANY VALUE

| When reviewing the types of multiples across your set of companies, look for consistency. Consistent multiples provide a reliable basis for comparison and evaluation.

Identify outliers or discrepancies. Ask: Why does one company have a significantly higher or lower multiple than the rest? Investigate what underlying factors could be contributing to variations between multiples and/or companies; use your judgment to remove outliers if necessary. |

Adjustments & considerations

To reach the final valuation on a term sheet, investors rely on a combination of qualitative and quantitative methods.

| Zeeshan Ali, Senior Investment Director at MaRS Investment Accelerator Fund (IAF), states that “venture capital funds exercise their own judgment in valuing startups by analyzing revenue projections, market dynamics and financial multiples. It is important to recognize that a startup’s valuation is subjective and can vary. Therefore, comparable analysis represents one of many methods for valuation determination.” |

In addition to quantitative analysis, qualitative considerations play a vital role in the valuation process. Evaluating a startup’s competitive positioning, founding team, level of technological innovativeness and operational efficiency ensures a more comprehensive understanding of its potential value. Assessing these qualitative factors can provide a more holistic perspective of your company’s worth.

Acknowledge that temporary market dynamics can influence valuation data. Fluctuations in the market, investor sentiment or broader economic conditions can impact valuation metrics and should be carefully considered.

Comparable company analysis is a useful valuation method for estimating your startup’s worth and equipping you with the insights and confidence required when raising capital. Researching comparable companies and discovering your industry’s multiples will enable you to gain a comprehensive understanding of your venture’s potential value and present a compelling case for funding.

Sources

- https://www.investopedia.com/terms/c/comparable-company-analysis-cca.asp

- https://corporatefinanceinstitute.com/resources/valuation/comparable-company-analysis/

- https://www.streetofwalls.com/finance-training-courses/investment-banking-technical-training/comparable-company-analysis/

- https://www.wallstreetprep.com/knowledge/comparable-company-analysis-comps/

- Interview with Zeeshan, MaRS IAF