Four tech verticals significantly impacted by VC funding—and what to do about it

While the impact of COVID-19 has been felt in every corner of the world, the new reality that is centred around healthcare innovation and is shaped by physical-distancing will likely have greater business and fundraising implications on certain technology-heavy verticals than others.

How are various technology-heavy verticals likely to fare?

According to Pitchbook, these are the top four emerging tech verticals that most likely to be significantly impacted in terms of demand and subsequently fundraising.

1. Retail health and wellness tech

The retail health and wellness tech vertical is expected to be amongst the most positively impacted by the pandemic. It encompasses:

- Virtual health

- Mobile and digital health

- Biometric wearables and devices

- Dietary supplements

- OMICS and personalized medicine

Aided by supportive legislation to promote telehealth in the US, in addition to an expected hike in government investment in health technology, this tech vertical should seek out investment now. To further position their case in front of VCs, companies should adjust their market size and projections—especially because there has been a surge in demand for mental wellness and physical exercise applications, as well as retail health and wellness technology.

2. Foodtech

With governments around the world ordering the closure of restaurants and consumer quarantining, demand for grocery and food delivery has experienced an exceptional hike. Although this demand might soften somewhat after the COVID-19 crisis, it is expected to remain high.

3. Mobility tech

This vertical, which represents companies that provide technology and services that are disrupting the transportation, automotive and shipping industries, is likely to be one of the most adversely impacted.

While this vertical already experienced some VC pullback in 2019, the current crisis characterized by physical distancing is likely to exacerbate the funding pullback as investors seek less risky opportunities.

Many autonomous vehicle companies have suspended their testing, and ridesharing apps have seen a sharp drop and, in some cases, the complete suspension of their carpool services. All this further impacts the funding opportunities for this vertical.

4. IoT

When it comes to the IoT vertical, the affects of the current COVID-19 crisis are heavily dependent on the actual application of the technology. For example, mainstream industrial IoT adoption is expected to wind down due to industrial enterprises reducing their IoT-related costs. However, IoT related to areas such as connected healthcare that enables remote patient monitoring, and smart cities that helps enhance pandemic responses, is expected to see increased demand—and consequently, increased funding—in the upcoming quarters.

It is also expected that cost-cutting for corporate venture capital in the IoT field coming from companies such as Samsung, Sony, Intel and Qualcomm is going to eventually make its way to investments.

Your funding stage matters

Another important factor that will play a role in your fundraising efforts is how much you’re looking to raise.

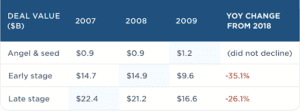

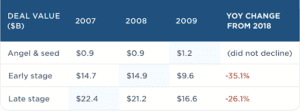

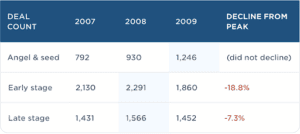

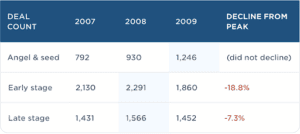

If we look back at how different funding stages were impacted by the 2008 recession, Pitchbook data shows that smaller-sized angel and seed-stage rounds (usually less than a $1 million) were the most resilient, and even witnessed an actual increase in both deal count and value. At the same time, both early-stage (less than $4 million) and late-stage funding (around $8 million) saw a decline in both count and value.

While it’s uncertain whether the trends will unfold the same way, angel and seed-stage rounds are still expected to fare better this time as well.

Source: PitchBook

Previous research by PitchBook reveals that during the 2008 recession, not only did venture investment slow down, but time between investments lengthened while valuations declined. This suggests that even companies that were able to raise money had to bootstrap longer than they may have otherwise.

So, what can you do to ensure your startup’s financial stability?

- Cut down your costs: While easier said than done, ensuring you cut down on your costs during such uncertain times is key to reducing your burn rate and extending your runway and potentially your startup’s life expectancy. Companies are advised to aim for a 12-month runway.

- Leverage your network to fundraise: While this has always been important, it is even more critical today as investors put more focus on their existing portfolio companies and receive more inbound interest from startups. Investors are more likely to respond if you come as a referral through a common contact than through cold calling.

- Be fully prepared: Because it’s harder to get investors’ attention right now, you cannot afford to not be prepared if and when an opportunity presents itself. Have these three key documents updated and ready to share:

i) Your company’s executive summary that gets you in the door

ii) Your pitch deck (ready for sharing and remote pitching)

iii) A financial forecast that includes a detailed cash flow - Focus your attention on non-corporate VC firms: While corporate VCs play an important role in the VC world, they are expected to pull back more aggressively than non-corporate VCs as they focus more of their attention on their core business.

- Start fundraising earlier: With fundraising expected to become a more competitive and timely process, start your fundraising efforts earlier to secure the capital you need for your operations and survival.

- Consider alternative sources of finance: On the positive side, today’s VC and financing markets are much larger and more diverse than they were during the last recession, offering companies a wider range of financial instruments.If you’re looking for equity investment at the angel or seed stage, or a later stage, there are tens of active investors willing to invest in Canadian tech startups. Hockeystick has compiled a list of 98 active equity investors looking to invest in a range of startups from early stage to scale-ups and in verticals that include healthtech, cleantech, fintech, enterprise software and more. Another key equity offering that any VC-backed tech startup should take advantage of is BDC’s new Capital Bridge Financing Program, which is meant to support venture-backed companies with matching investments.There are also a range of Canadian financial institutions offering a variety of debt instruments for startups in specific verticals and at certain revenue thresholds. Such institutions include Export Development Canada, BDC, CIBC Innovation, Quantis and Flow Capital. See the full list of debt providers here.