Total Addressable Market: A Beginner’s Guide to Market Sizing

The size of a market is often one of the first aspects considered by a startup or investor when assessing a solution for a problem space. This is frequently one of the main drivers for startup building and venture capital allocation. Market sizing is critically important, and a detailed approach will help guide a startup in its product development and go-to-market strategies.

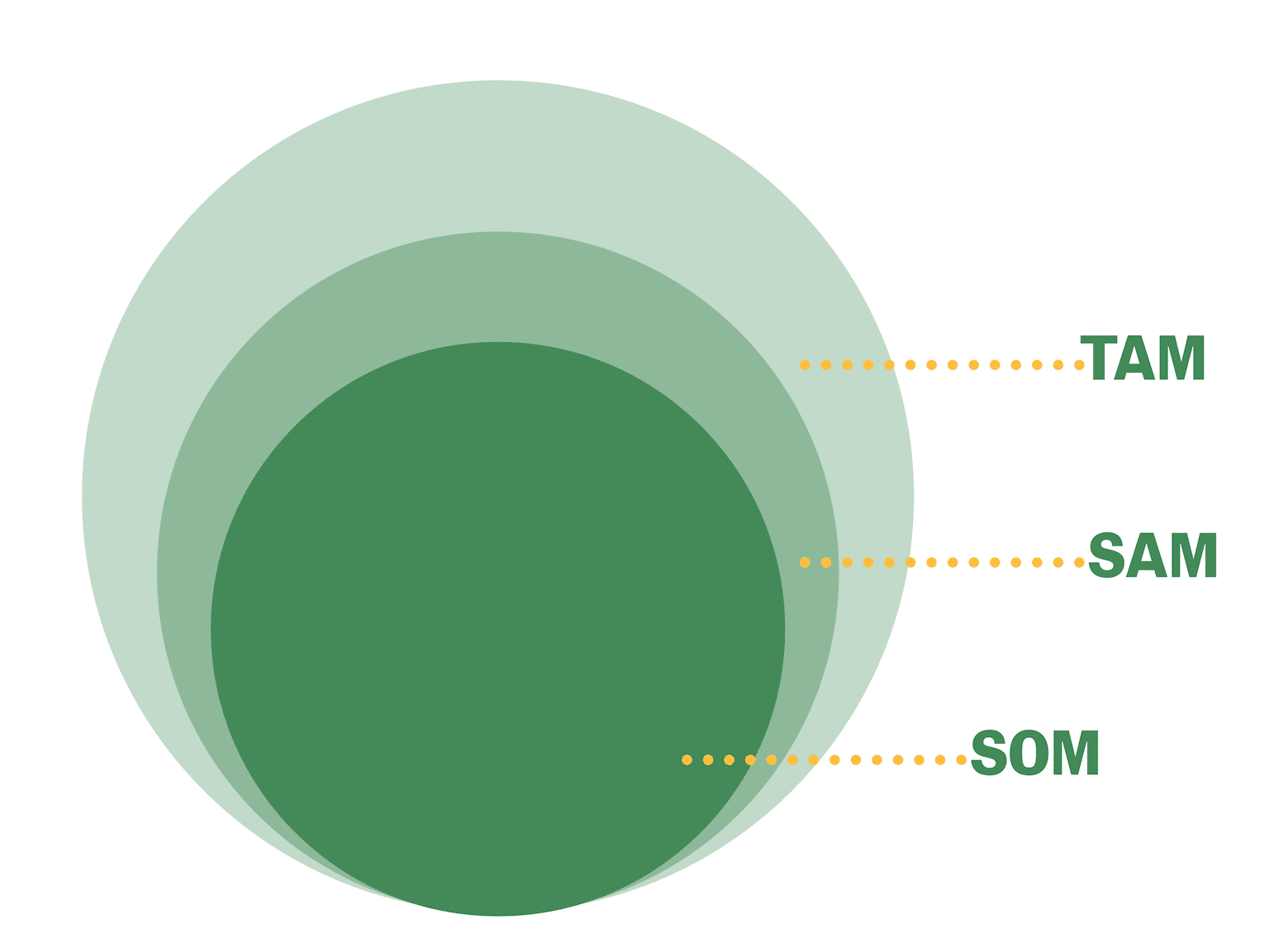

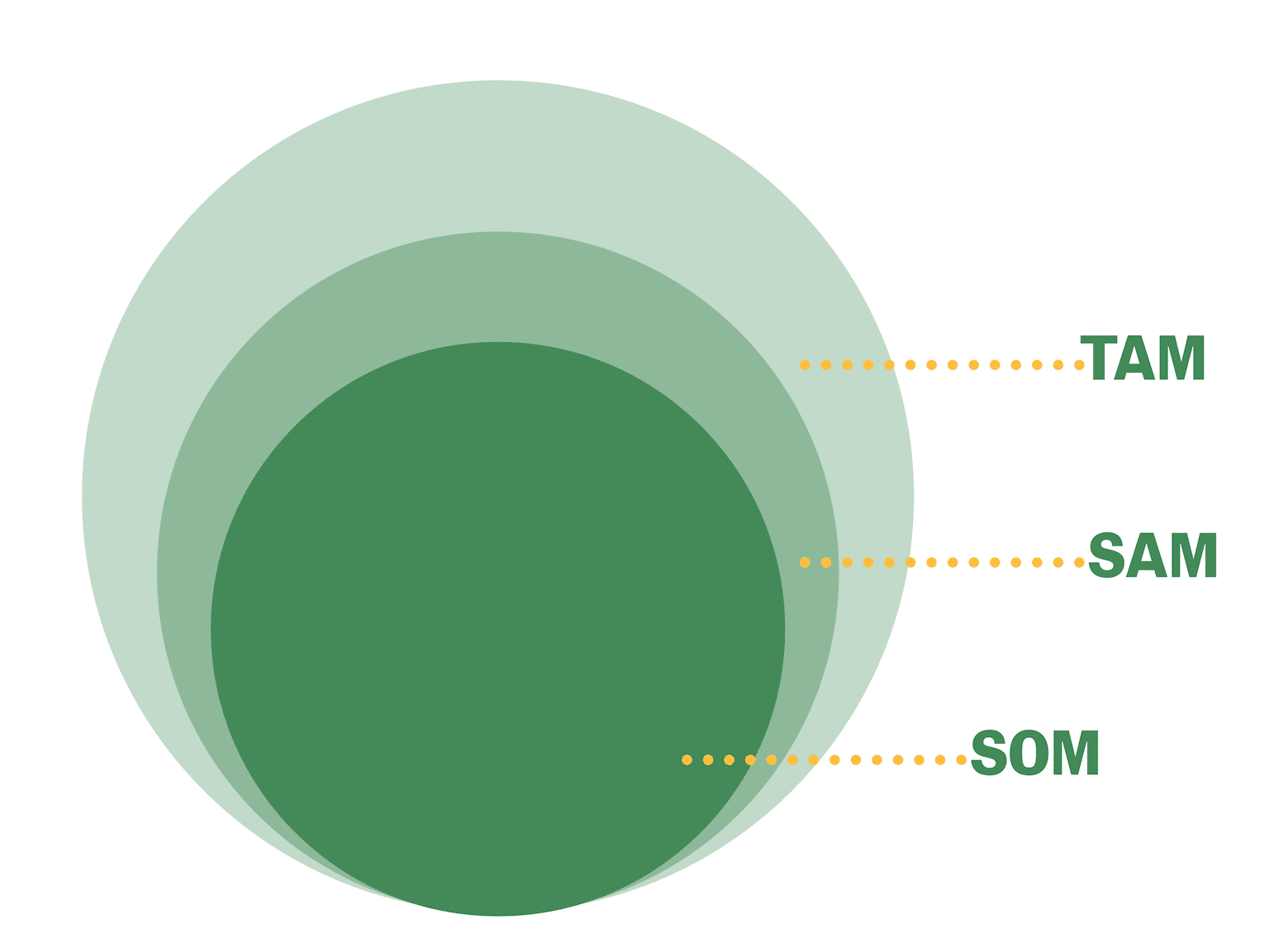

When assessing the potential market for a product or service, there are two commonly used metrics: Total Addressable Market (TAM) and Serviceable Addressable Market (SAM). While these two terms are often used interchangeably, they refer to different things.

- TAM is the total market size for a product or service. In other words, it represents the total potential revenue that a company could generate if it captured 100 percent of the market for that product or service.

- SAM, on the other hand, refers to the portion of the market that a company can realistically target and serve.

In addition to these two metrics, there is also Serviceable Obtainable Market (SOM), which represents the portion of the SAM that a company can realistically capture based on its resources, market position and other factors.

The starting point for estimating market size will be identifying your TAM for a specific product and its relevant target markets. This is done through projecting customer profiles and estimating an average pricing for your product.

When calculating your TAM, there are two main approaches.

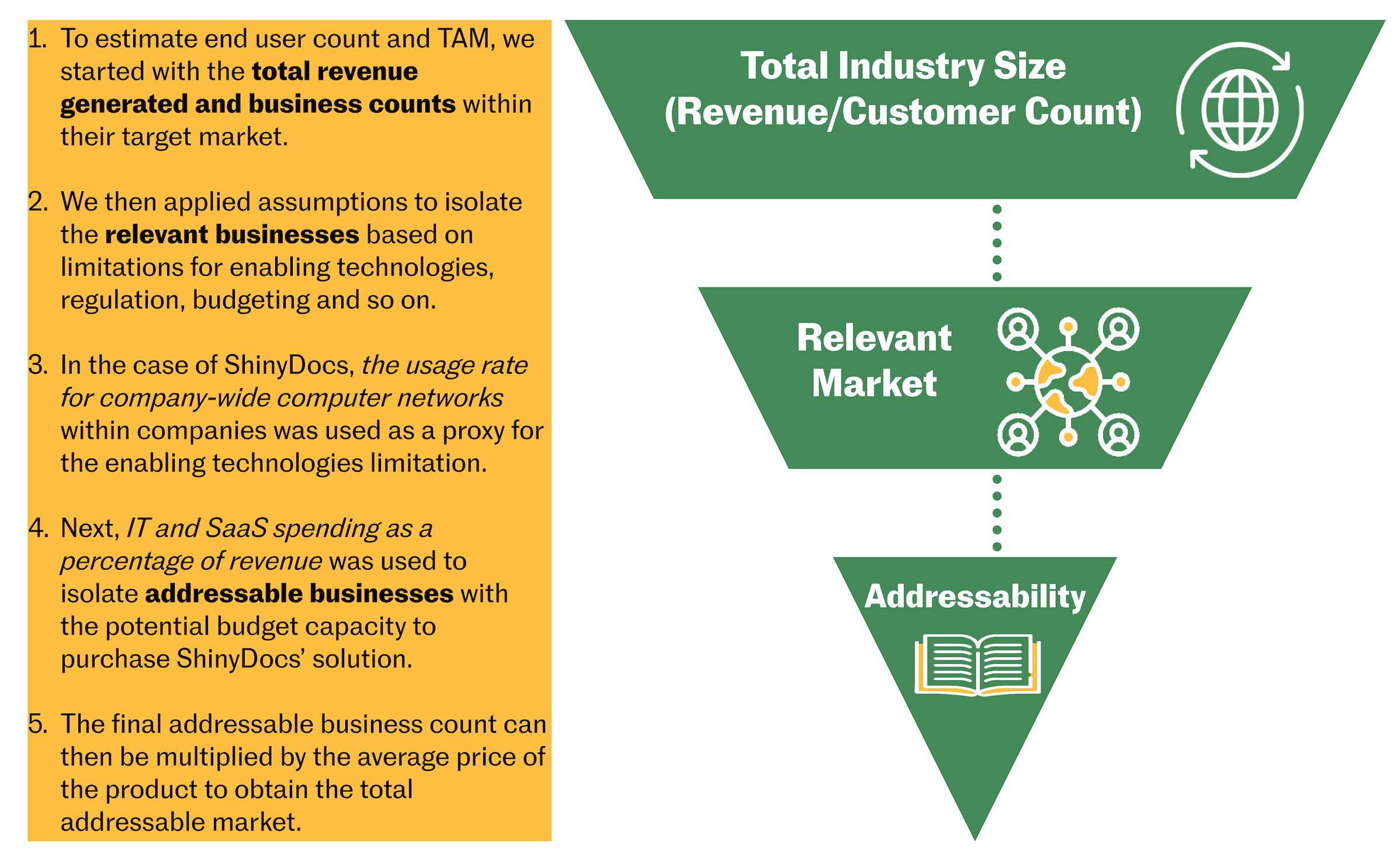

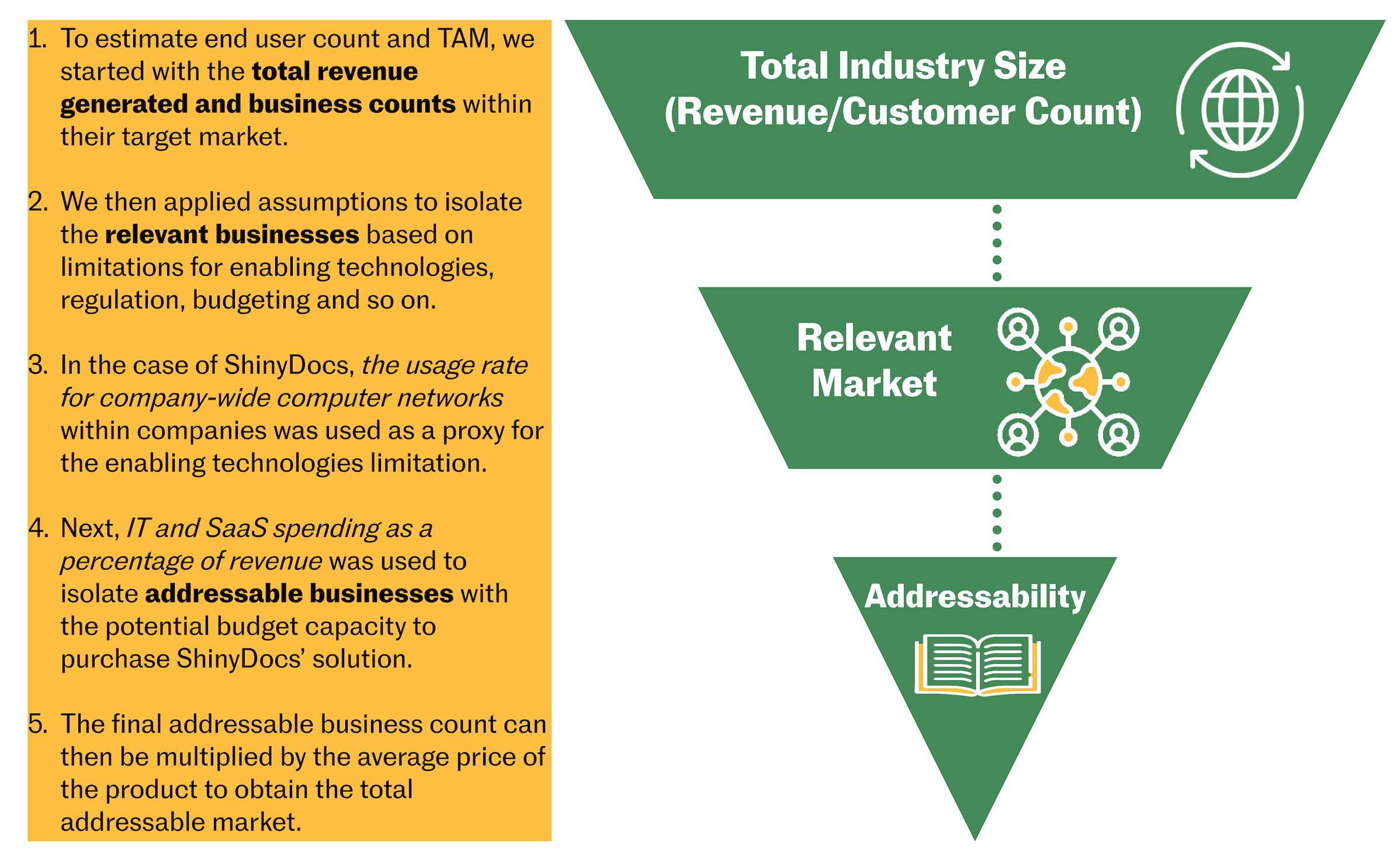

The top-down approach takes a broad market figure, such as the total customer count or global revenue of an industry, and then narrows it down to the specific target markets.

The bottom-up approach starts with specific customer data and then aggregates or extrapolates from it to determine the total market size.

Let’s explore each approach in more detail.

1. Top-Down Approach

Top-down analysis is relevant and possible when there is reliable and comprehensive data available for the entire market, especially when the market is well established for a particular product or service.

When that’s the case, market research firms and industry reports can provide reasonably accurate data on market size and market share.

Below is an example of how to use the top-down approach to calculate TAM.

Case Study: ShinyDocs

ShinyDocs develops information management software for unstructured data. Their end market is industry agnostic.

2. Bottom-Up Approach

The bottom-up approach is relevant and possible when there is enough data available on the target market. This approach breaks down the market into its smallest possible components, such as individual customers or small businesses, and then estimates the total market size based on relevant assumptions.

By taking this approach, companies can gain a better understanding of the distribution and segmentation of their potential customers.

Below is an example of how to use the bottom-up approach to calculate TAM.

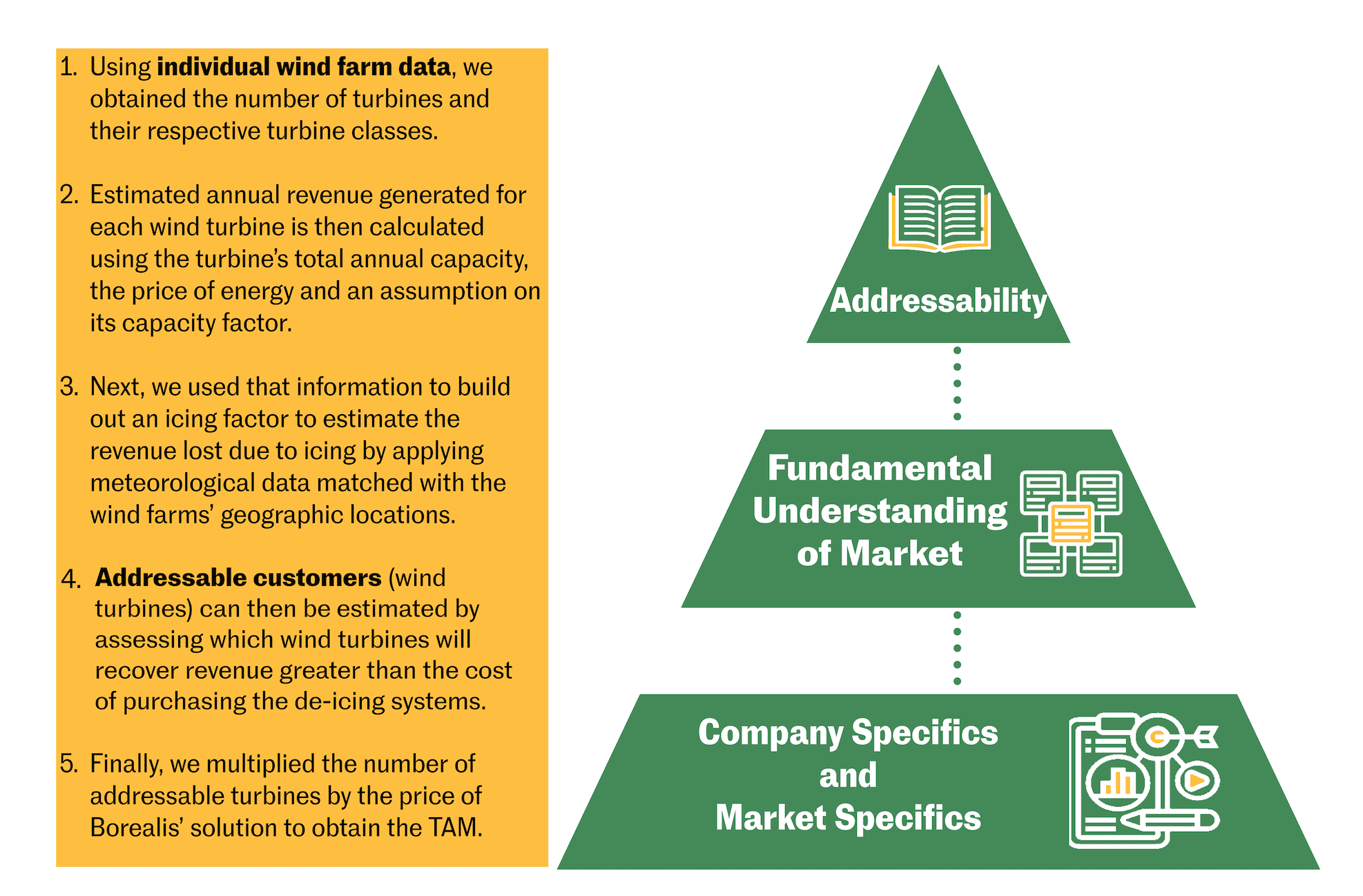

Case Study: Borealis Wind

Borealis Wind is a retrofitted wind turbine de-icing system. The company targets industrial wind farms that experience revenue losses due to icing.

The importance of assumptions

When calculating TAM, it is essential to make assumptions based on available data. These assumptions can include the potential market size, customer behaviour and market trends, or as in the case of our two examples, limitations that help isolate addressable customers. These will often be the most important features of your TAM model and will require educated guesses and validation through in-market research.

Conclusion

Both the top-down and bottom-up approaches are useful when estimating TAM. While the top-down approach is suitable for industries with limited data, the bottom-up approach is more useful for industries with more granular customer data. By making assumptions based on available data, companies can properly assess the size and features of their target markets and use that to inform different parts of their strategy.

Tips for developing and using your TAM:

- Public data sources, such as Statistics Canada, will often be a valuable resource for developing your top-down models.

- Developing and corroborating your foundational assumptions with industry experts will allow for more objective assumptions.

- When initially building your TAM, be sure to include any segmentations you may need for go-to-market and product development strategy.

- Combining both top-down and bottom-up methods can often lead to a more holistic view of the market due to the data availability limitations that often hamper bottom-up approaches.

- Incorporating such primary research methods as customer interviews and surveys into your bottom-up analysis will validate assumptions and create granularity.