How to deal with the unprecedented disruption in supply chains

In an era when “disruptive” has come to symbolize breakthrough technologies and processes, the global COVID-19 pandemic has given us a stark look at the true meaning of the word.

Employment, trade, goods and services, tourism and travel — even our ability to socialize — have been disrupted to an unprecedented degree. It’s as if the world has been put on pause. Air Canada, for example, announced March 30 it would be temporarily laying off 15,200 workers and 1,300 managers. Automotive sales are down 20 per cent this quarter. Canada’s tourism sector is predicting heavy losses. And the supply chain — that intricate web of commerce that delivers essential goods and services to the companies that rely on them to deliver their products and services — has been severely compromised.

Already, nearly 75 percent of companies are reporting supply chain disruptions due to the pandemic, according to the Institute for Supply Chain Management. Many of those disruptions are the result of transportation restrictions. “Companies are faced with a lengthy recovery to normal operations in the wake of the virus outbreak,” says Thomas W. Derry, Chief Executive Officer of ISM.

The road ahead will be challenging

As the pandemic worsens, so too will the impact on the global supply chain. Some companies will not survive COVID-19. The key to survival, experts say, is to recognize trends, analyze current data and quickly pivot. Data and informed decision-making is crucial. Just as people can decrease the risks of COVID-19 by following common sense, so too can companies. Consider this article a supply chain management survival guide.

Up-to-date data is crucial

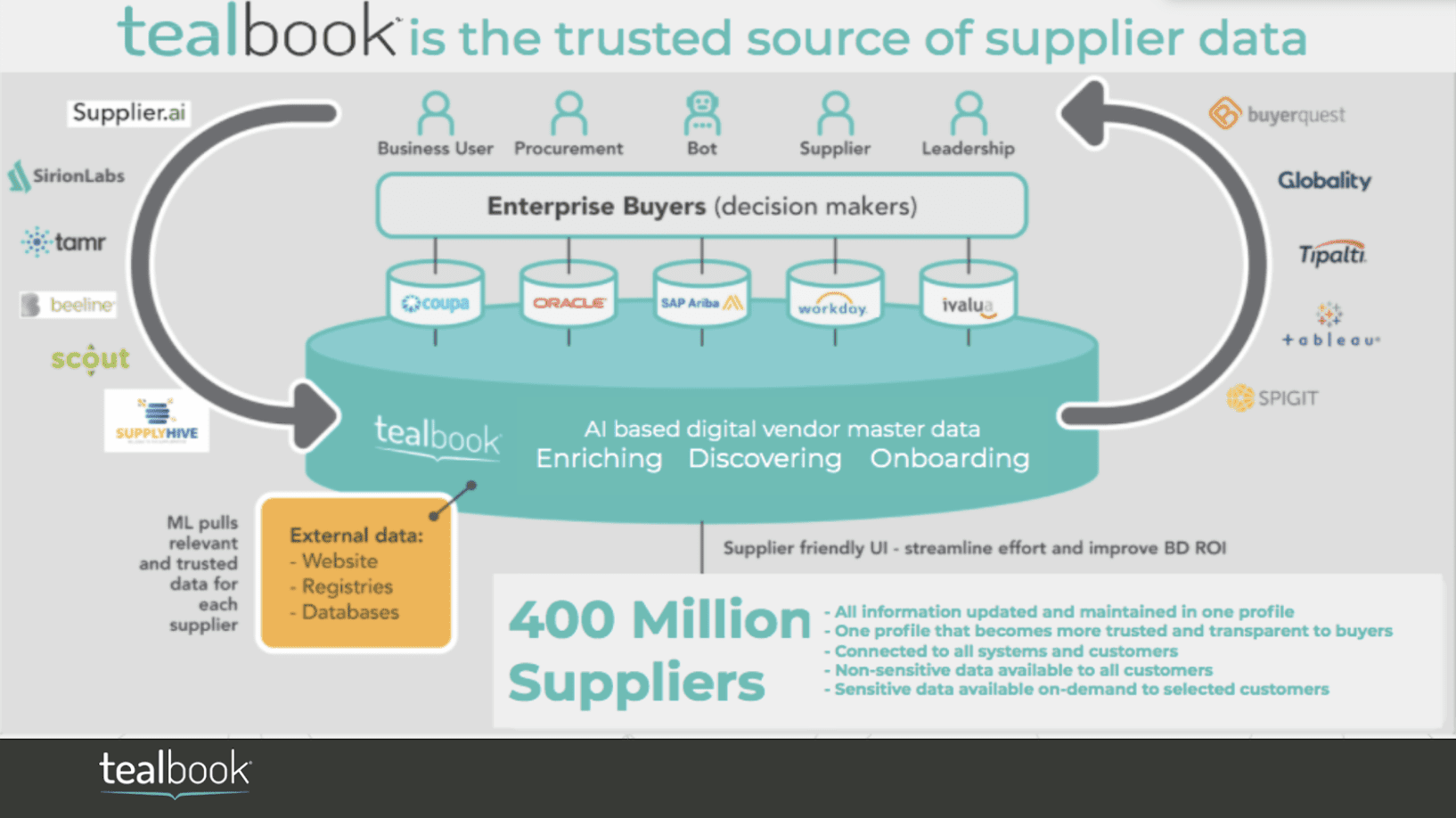

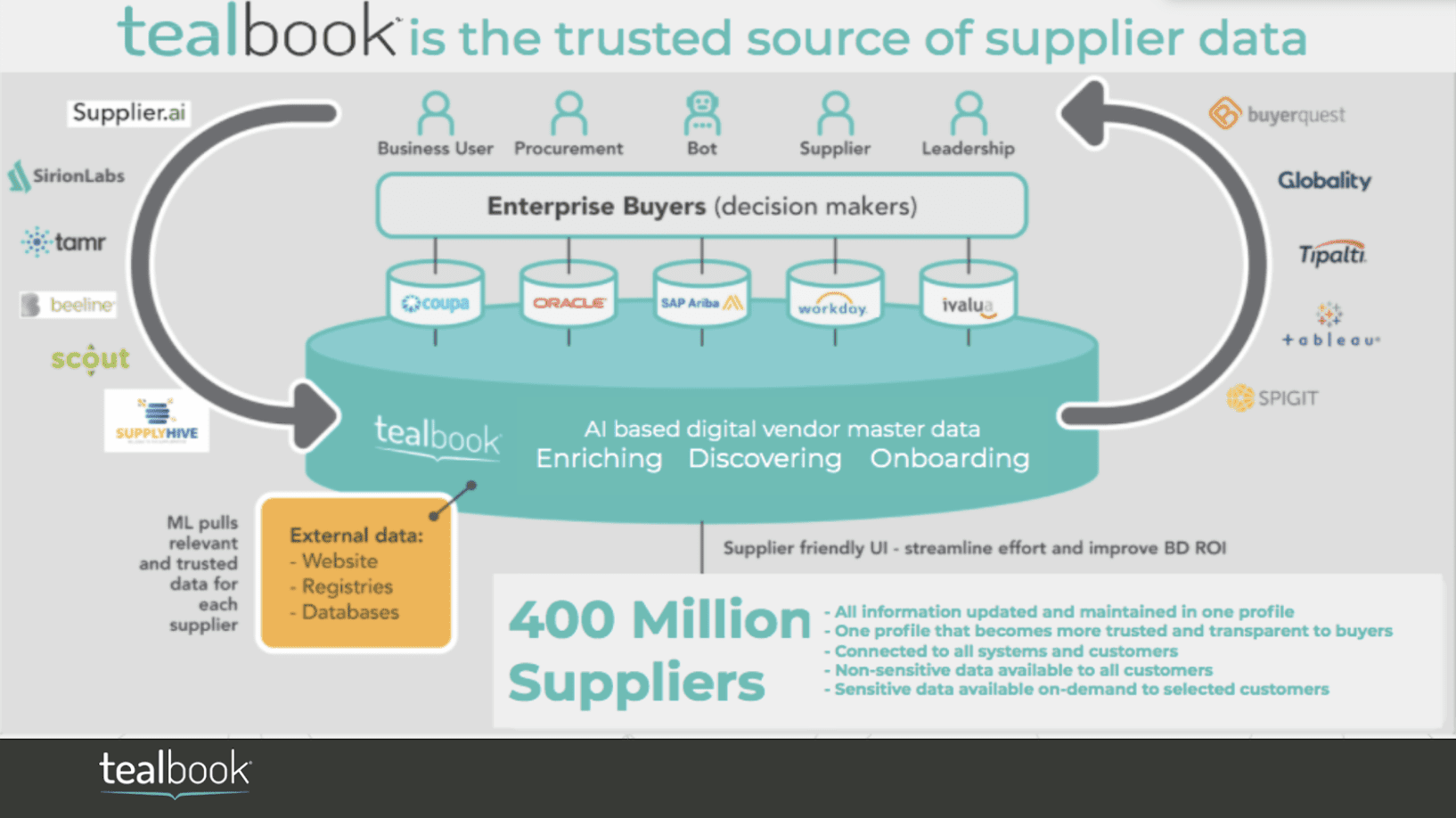

It’s Stephany Lapierre’s business — literally — to see the big picture. She’s the CEO of Tealbook, a Toronto-based big data company that analyzes information across all B2B companies globally, bringing agility to supply chain and procurement.

Tealbook, using machine learning, constantly crawls some 400 million suppliers to maintain a near-realtime database. That information is translated into a LinkedIn-style interface, where client companies have critical data at their fingertips: What are suppliers’ capabilities at a detailed level? How many others can provide similar products and services? What trends are appearing among similar industries and corporations? If one supplier starts to falter, what’s the buyer’s next best option? Who can be contacted?

For companies with even mildly complex supply chains, up-to-date data can

make or break the business. That’s true in the best of times — and it’s especially crucial now. Lapierre, who is in contact with procurement executives from many Fortune 100 companies, has never seen anything like the COVID-19 situation. In an interview March 30, still early in the pandemic, she said she’d already identified multiple trends — as well as supply chain management strategies for coping with these situations.

Look for ways to reduce costs

Companies are expecting to lose a significant amount of revenue and are looking at their supply chains as a way to reduce costs. “We have a company right now that is looking at a 20 per cent cost reduction from their entire supplier base,” says Lapierre. “That’s significant — we’re talking about having thousands of companies it needs to reach out to and negotiate with.”

The earlier companies can identify and act on these new realities, the better the outcome.

Seek out new supply lines

Supply lines have already been affected — and greater problems lie ahead.

This is different from toilet paper. Panic buying is a demand spike that causes a temporary shortage — not a fundamental change to the supply chain. There’s not a shortage of toilet paper or trucks, and the distribution chain is intact. If there’s no toilet paper today, there likely will be tomorrow. But that’s not the case with many products critical to the supply chain. Already, some buyers are finding suppliers don’t have enough of what they need. For instance, Personal Protective Equipment — notably N95 masks — are in short supply. And while a massive increase in demand has contributed to shortages, the supply chain has itself been disrupted. Large mask factories were affected during the lockdown in parts of China, and a myriad of other factories producing a myriad of widgets globally are either not producing or producing at a reduced capacity.

Companies need to seek out new suppliers that can provide similar products or services. “And the faster you get there, the more you’ve given your company a competitive advantage,” says Lapierre, adding the caveat that there has been an increase in the black market. She counsels companies to look for trusted suppliers with valid certifications in order to avoid unnecessary risk.

New products mean new suppliers

Some companies are temporarily shifting production to an entirely new product, either voluntarily or as the result of a government directive (think ventilators, face shields, etc.). Canada Goose has shifted from outdoor clothing to scrubs and patient gowns and Linamar is adjusting its manufacturing facility to produce ventilators.

These companies may well have in-house expertise, but this change usually requires entirely new supply chains, with trusted suppliers. Again, data is critical. Even these new suppliers may be disrupted as the pandemic evolves.

Labour concerns are also slowing things down

Without people, the supply chain halts. And people, justifiably, have some concerns about working during a pandemic. Employees of Instacart are striking due to a shortage of Personal Protective Equipment. Whole Foods employees were also discussing labour action for the same reason in late March, while other companies — particularly those involved in selling or delivering groceries and take-out foods — were scrambling to hire thousands of new temporary workers. If labour disruptions trend beyond short-term, it may be necessary to find new suppliers.

Find a way to get the best information

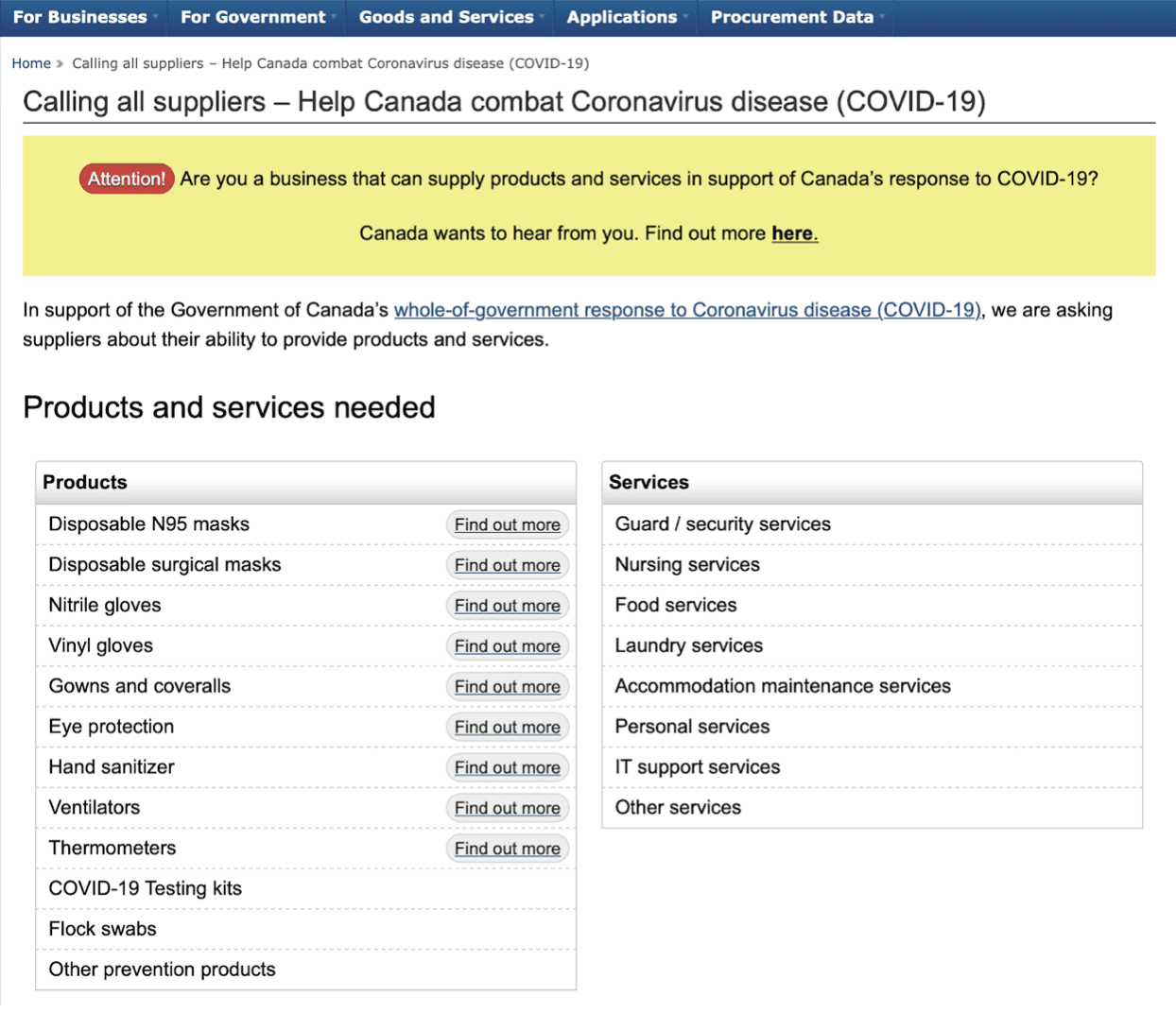

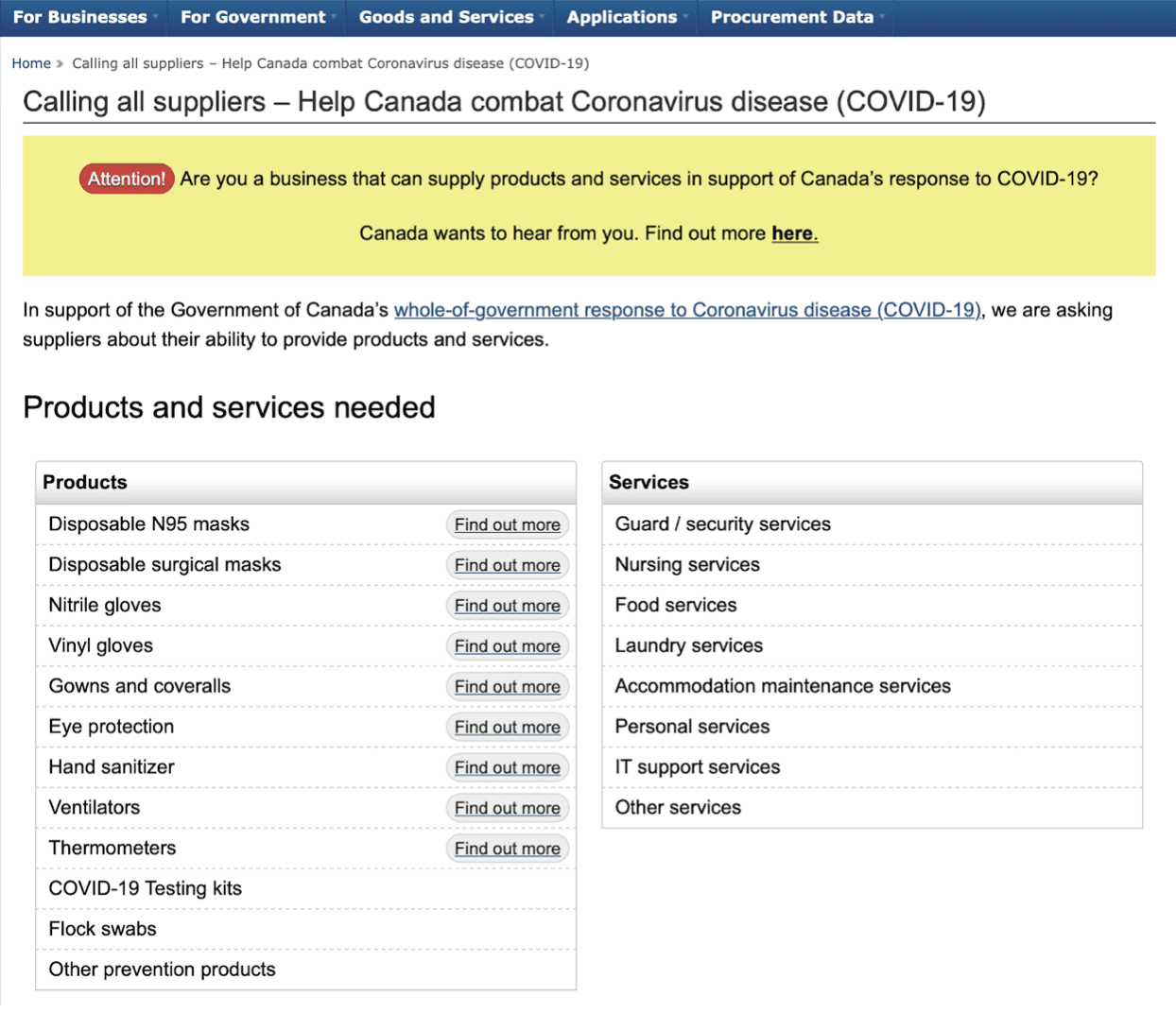

To ramp up production of critical goods and services, the federal government has made a broad call for suppliers. Simultaneously, however, provinces and cities are making their own calls. The response from suppliers is overwhelming, with no easy mechanism to evaluate companies and their proposals.

The result? Disparate databases, hampered by overlap, omissions and inefficiency. Far better, says Lapierre, to utilize autonomous data enrichment to create a universal supplier record — an area where Tealbook excels. Updated using AI, it would be connected to all disparate systems and databases, offering transparency for all.

Key ways to be proactive

As the pandemic evolves, Lapierre emphasizes that everything hinges on quality data.

In this unprecedented situation, Tealbook is offering any organization free data. The Tealbook team staff will pull a report of all qualified suppliers suitable to that particular supply chain, so that companies can quickly and significantly expand their vendor list. Tealbook has received hundreds of supplier requests already and supported such organizations as GM, Brooks Brothers and the City of Tampa..

Ultimately, Lapierre advises companies:

- Ensure visibility and up-to-date data across their entire supplier base to leverage existing relationships and contracts;

- Identify and prioritize cost-savings opportunities across their supplier base;

- Communicate actions and needs to suppliers;

- Buy locally versus globally where possible;

- Communicate internally to avoid duplication of efforts and capitalize on each other’s sourcing initiatives. Build a COVID-19 alert system to share new information internally in real-time.

“Having second or third sources in place is so important,” says Lapierre. “And data that speeds up the decision-making is crucial.”