Case study: Partnering with major players in drug development

Nicoya Lifesciences is a developer of benchtop surface plasmon resonance (SPR) instruments and associated software. The company has seen success in adoption with research groups across multiple Canadian, U.S. and international academic institutions, as well as the biopharmaceutical sector. Their key value propositions include ease of use, low sample requirements and extensive customer support, as highlighted by their previous customers.

What was Nicoya’s key research need?

As part of their new product launch strategy, the team at Nicoya wanted to understand the characteristics of other players in the drug discovery landscape. The MaRS Market Intelligence (MI) team worked with Nicoya to identify the most promising partner from the comparison of three end-user markets:

- Contract research organizations (CROs)

- Biopharmaceutical companies

- Academic research institutes

| Contract research organizations emerged as the market with the strongest opportunity for future partnerships and adoption of Nicoya’s solutions. |

Our research process: Building your criteria and scorecard

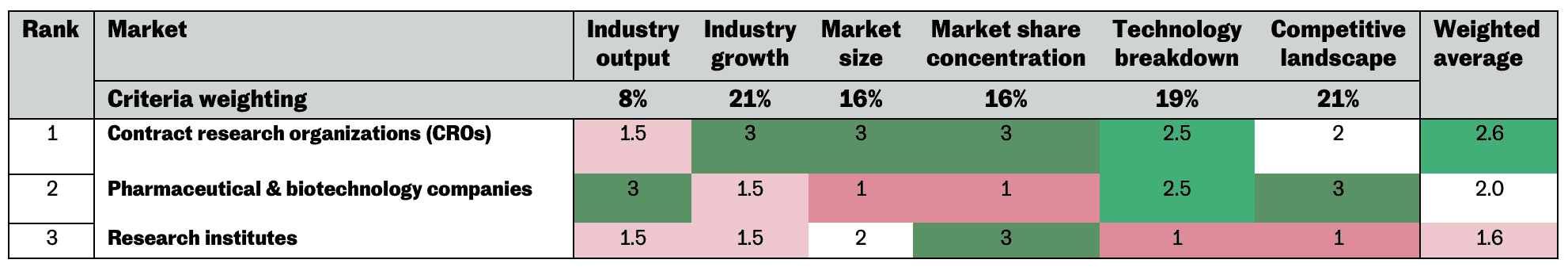

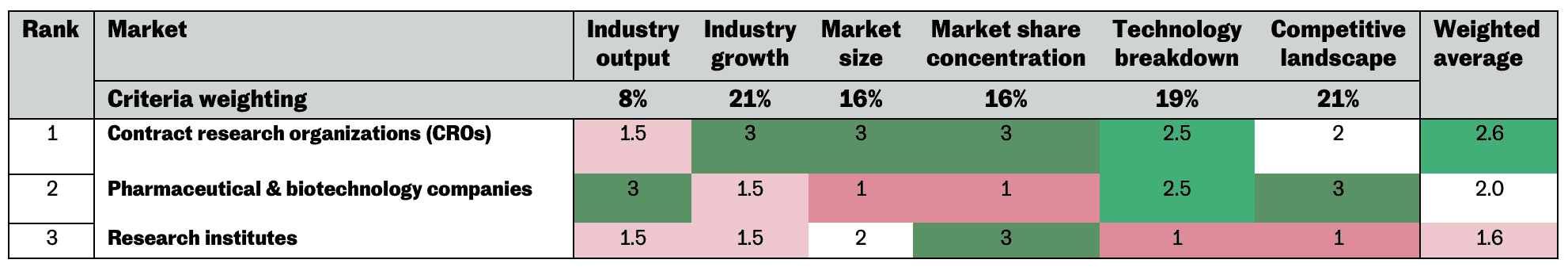

A ranked scorecard approach was taken in comparing major end-user markets for drug discovery technologies. This method assesses the overall strength of each market across multiple factors and assigns a ranking to each market based on its relative position to the other markets.

The MaRS MI team highlighted factors to determine best market fit, and in collaboration with Nicoya, a greater weighting was applied to specific factors.

- Growth potential: Projected revenue and R&D expenditure

- Technology landscape breakdown: Adoption of technologies similar to SPR (mass spectrometry, chromatography and tools capable of high-throughput screening and proteomics)

- Competitive landscape: Number of competing products in similar technologies

These factors were considered as higher impact for Nicoya’s team because they represented the current landscape for drug discovery tools and future market potential.

Market opportunity assessment scorecard

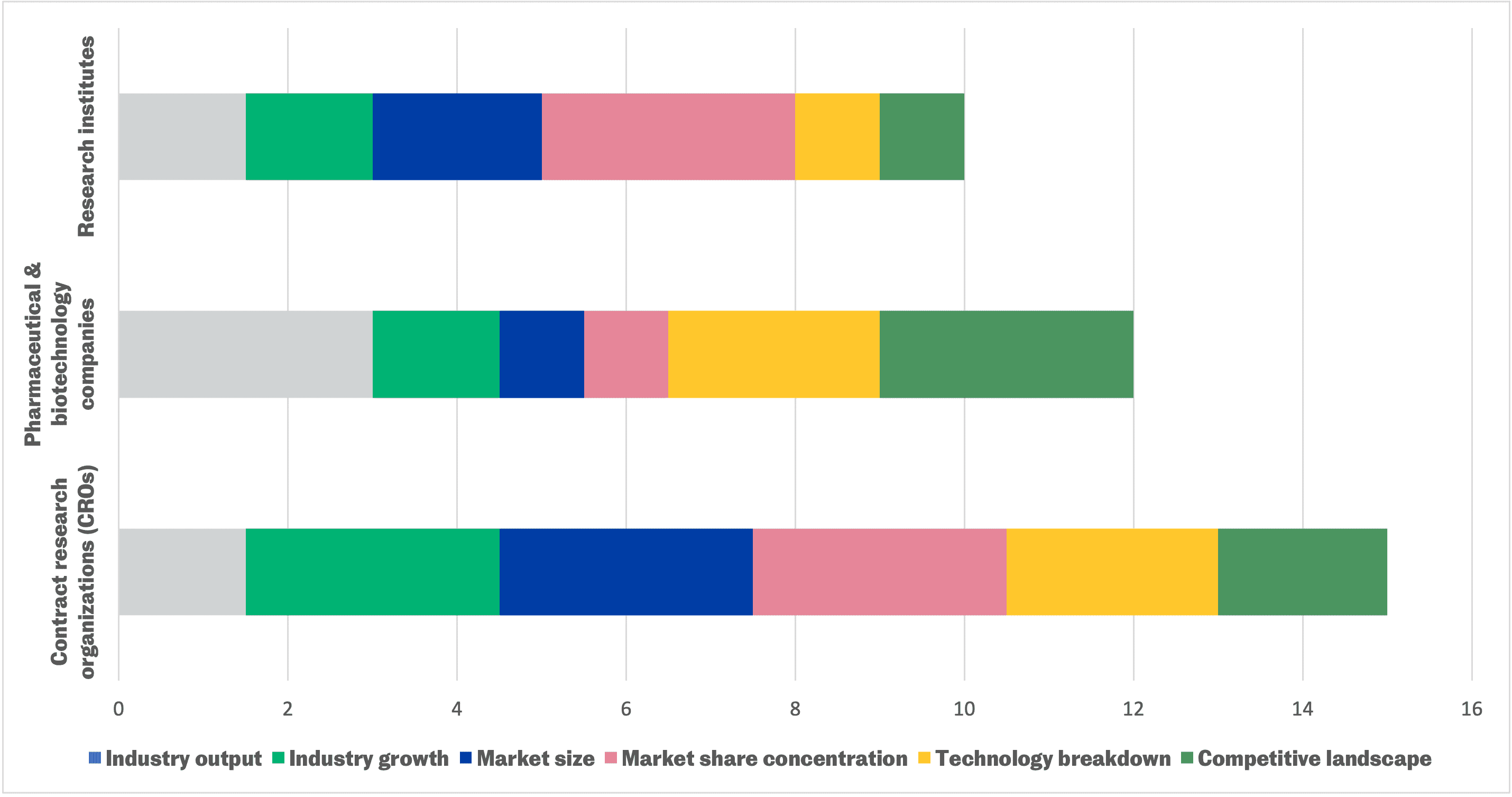

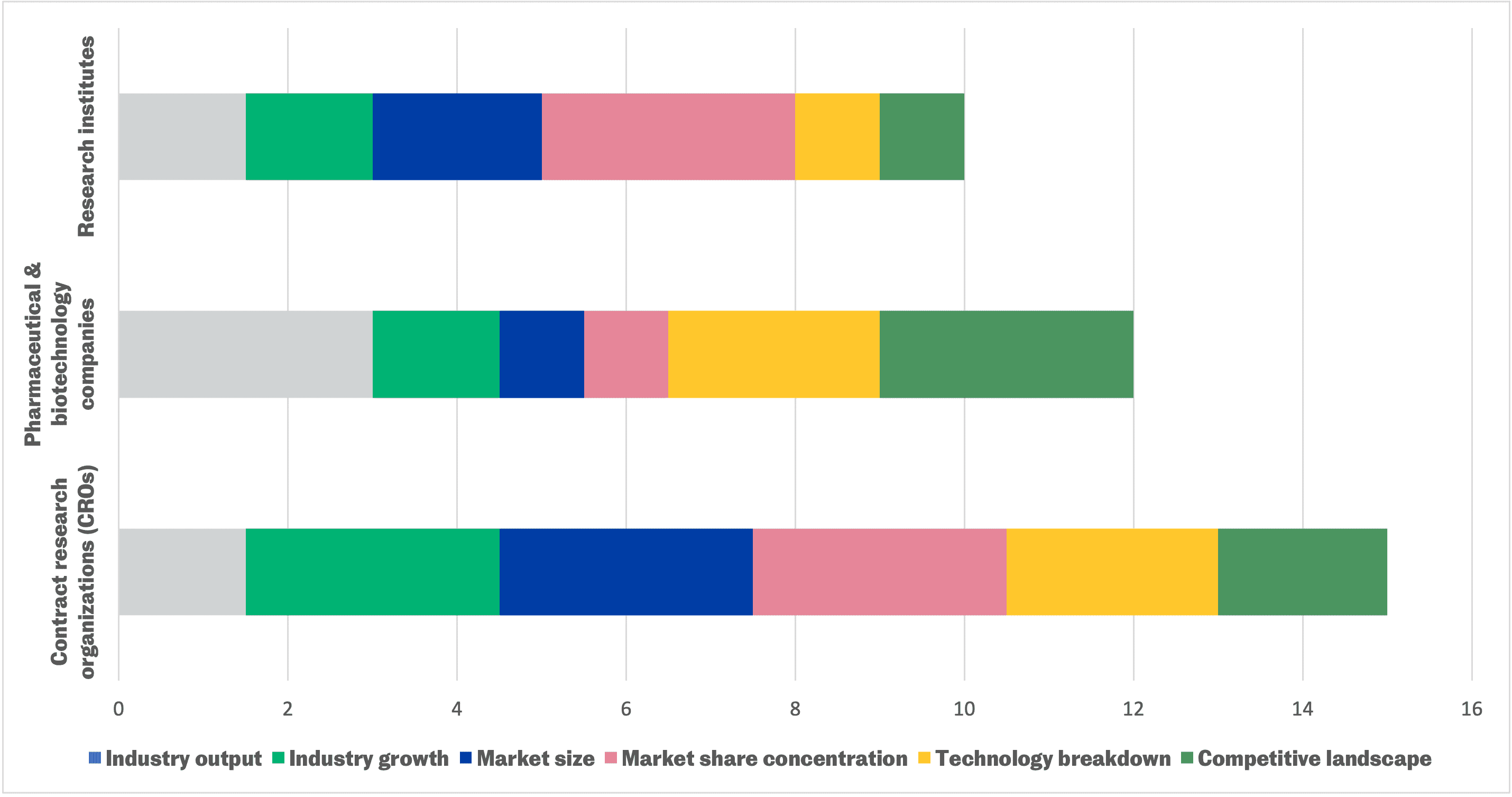

Scorecard impact visualization

Summary of key factors

Below is a description of key findings that showcased the strength of CROs as a key drug development player.

| Factor 1: Strong adoption of similar technologies |

|

| Factor 2: Highest growth potential |

|

| Factor 3: Largest market size |

|

Contract research organizations also demonstrate an increasing degree of specialization for specific drug development stages and therapeutic areas, with a majority of revenue derived from active pharmaceutical ingredient (API) manufacturing. They also service early-stage biotechnology companies that lack proper facilities, expertise and funding to conduct in-house drug development.

Conclusion: The opportunity CROs present

From this research, CROs demonstrate the strongest opportunity for partnership with Nicoya, as they present the greatest potential for adopting their products and showcase promising growth potential and immediate sales opportunities.

Client feedback:

| “The MaRS Market Intelligence team is able to quickly understand the market, drivers and key factors relevant to strategic planning for high-growth companies. Even with our highly technically complex industry, the team was able to refine and deliver actionable insights for us. The final deliverable presented an impressive depth and breadth of information. Each meeting was conducted professionally, and the process enabled us to better align internally on our market strategy.”

– Product manager, Nicoya |

Next steps: Determining partnership fit with CROs

If your startup is developing novel technologies or platforms for drug discovery or development, CROs may be promising partners. Several areas of opportunity, as highlighted by our market research vendors, can help dictate whether your solutions have adoption potential with CROs.

| Areas of opportunity | How they support CROs |

| Artificial intelligence in early-stage drug discovery | Accelerate target validation, compound lead drug selection and optimization |

| High-throughput screening optimization for anti-RNA small molecules | Develop and optimize workflow for developing small molecules targeting RNA |

| Ex vivo and in vivo pharmacology expertise and platforms | Develop and enhance disease models for emerging therapeutics areas, such as oncology and metabolic disorders |

| Expression platforms and large molecule API manufacturing | Support development and manufacturing of next-generation biologics and/or biosimilars |

| Biomarker assay development and/or real-world evidence integration | Support phase IV and/or post-marketing surveillance studies |

Sources: Frost & Sullivan, GlobalData